The price of Bitcoin reached $25,694.23 at the start of trading on Tuesday, marking a 1.19% loss over the past 24 hours, pushing it below the $26,000 level. This drop continues due to ongoing uncertainty surrounding the approval of Bitcoin Exchange-Traded Funds (ETFs) in the United States. Other cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Litecoin (LTC), and Solana (SOL) also followed Bitcoin’s lead in declining. Stellar (XLM) was the exception, showing the largest gain with nearly a 3% increase over the past 24 hours.

The global market capitalization of cryptocurrencies stood at $1.04 trillion this morning, registering a 1.06% decrease over the past 24 hours. In my opinion, Bitcoin is currently trading around the $25,600 range due to the ongoing uncertainty surrounding the potential launch of an immediate Bitcoin ETF in the United States. This price movement indicates the presence of negative sentiment in the market.

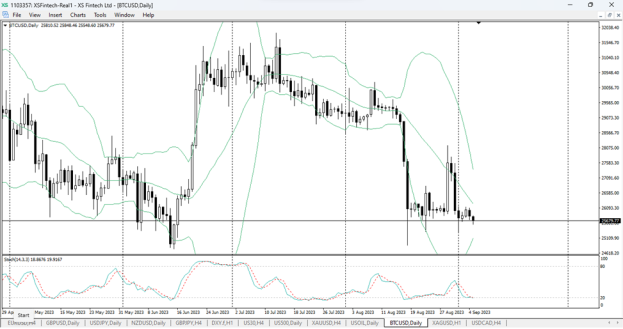

After the recent rise to $28,000, Bitcoin remained within a narrow range between $25,800 and $26,000. These increases came following a federal appeals court ruling that asked the Securities and Exchange Commission (SEC) to reconsider its rejection of Grayscale Investments’ GBTC conversion into an ETF. However, Bitcoin faced a setback as the SEC postponed decisions on expected ETFs on Friday, leaving traders uncertain about the sustainable recovery of Bitcoin’s price.

I see Bitcoin currently facing a challenging environment, and the possibility of it dropping to $22,000 is becoming increasingly likely. I can say that this downward trend reflects investor sentiment volatility in the Bitcoin and cryptocurrency market. Despite the initial enthusiasm surrounding Grayscale’s legal victory against the SEC and the European Training Institute’s demands, this optimism quickly waned.

Attempts to break the $28,000 support have failed, and the shrinking general budget of the Federal Reserve, which has fallen to $8.12 trillion from its peak in March 2023, has added to the uncertainty in high-risk markets. This suggests that liquidity is flowing out of markets, weakening Bitcoin’s role as an inflation hedge. While Bitcoin has maintained the $25,000 level since March, the fate of the BTC ETF remains uncertain, diverting investor attention away from the cryptocurrency market at the moment.

From a technical perspective, markets are expected to experience a slowdown in trading and a decrease in liquidity in the coming period as investors await decisions from the U.S. Securities and Exchange Commission (SEC) regarding Bitcoin exchange-traded funds (ETFs). There are two possible outcomes following this move: an upward breakthrough or a downward trend. The stronger scenario leans towards a decline as BTC approaches the support level of $24,995 and extends losses to the critical support level of $24,000.

In the worst-case scenario, Bitcoin’s price could drop to the demand zone between $21,711 and $20,155. These predictions draw strength from signals from the Relative Strength Index (RSI), which is currently decreasing, indicating bearish momentum. Similarly, the bars of the Awesome Oscillator indicator are rising in red, signaling a strong bearish sentiment in the market.

In another scenario, an upward surge in Bitcoin’s price could change the current trend if the price returns above the strong level at $28,000, last tested on August 29. A breakthrough above it could send Bitcoin to levels beyond $29,692 or $31,518.