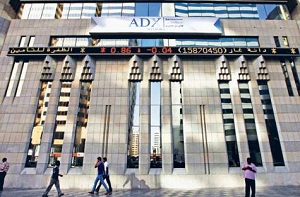

Abu Dhabi Securities Exchange (ADX) has signed an agreement with the National Bank of Abu Dhabi (NBAD) paving the way for the listing of bonds and new debt instruments at the exchange.

The signing of the agreement comes in accordance with ADX strategic objectives of diversification of products and to create a bond market operating under the best standards.

The agreement paves the way for new debt instruments to be listed and traded on ADX as their primary platform, which will help to create a more attractive and dynamic climate for investment in Abu Dhabi.

Under the listing arrangement for the bonds, (NBAD) will act as ADX s account operator. Settlement and clearing will take place via NBAD through ADX s participant account at Euroclear, which specialises in the settlement of securities transactions as well as the safekeeping and asset servicing of these securities.

NBAD s role will provide a window for investors who wish to trade or hold investments in the bonds, through ADX without holding an account with Euroclear, and will facilitate cross border settlement and clearing of trades in the bonds.

Rashed Al Balooshi, CEO of ADX, said, “We are continually looking at ways to attract investment into Abu Dhabi through the Exchange. We have all the modern infrastructure and procedures to support such new investment, whether it is denominated in UAE Dirhams or in foreign currencies. The new regulations introduced by ESCA are an important step in this process and remove yet another reason for companies and institutions to look elsewhere for raising capital.” He added, “Longer term, local fixed income and sukuk issuances will encourage more infrastructure funding and attract institutional capital flows, as well as the creation of a local yield curve.” Hany Samir, Managing Director of NBAD s Custody said, “We see our partnership with ADX on this listing as very much a contribution to Abu Dhabi s future growth and development. The ability of ADX to list such instruments will encourage and increase UAE fixed income issuance, and will add to the depth and variety of options for investors.” It is worth noting that ADX has one bond listed, which is by NBAD in the form of subordinated convertible notes.

Source : WAM News Agency for United Arab Emirates